In a landmark court decision, the High Court of Australia ruled (in a narrow 4-3 ruling) in the case of Vanderstock & Anor v State of Victoria, that the Zero and Low Emission Vehicle Distance-based Charge Act 2021 is invalid under Section 90 of the Constitution as it imposes a duty of excise. The charge was known as the ZEV in Victoria.

This effectively means Victoria’s distance-based road user charge (RUC) for battery-electric and plug-in hybrid electric vehicles is illegal. The basis for the decision is interesting, as it appears to be that:

The charge was deemed by the court to be “a tax on goods because there is a close relation between the tax and the use of ZLEVs, and the tax affects ZLEVs as articles of commerce, including because of its tendency to affect demand for ZLEVs”.

If I put my legal hat on (I am a lawyer), this is quite an interpretation, as it seems to regard the charge as being an excise because it affects demand for zero and low emission vehicles. This blog is not the place to debate the legal arguments, indeed the dissenting judgments amply raise the key issues.

The obvious policy question is if a charge of A$0.028 per km on the use of zero emission vehicles is an excise because of its "tendency to affect demand for ZLEVs”, and if the tax (it was critical that it be deemed a tax, and not a fee for services) is a tax on goods, is not the annual registration fee (which is A$876.90 (US$553) for a car in a metro area of Victoria) similar? It is effectively a tax on being able to use the car.

However, the court has ruled, and it does beg a wide range of questions both at the strategic policy level around charging road vehicles to use roads in Australia, and the effect the decision has on the options to do this. At a basic level there are two points:

1. The Victorian ZLEV tax as it was designed is unconstitutional: This was a mandatory charge, that had no option (as applies in some states in the US) to pay a flat annual fee instead, which only applies to a small proportion of light vehicles. Would a tax that had another option be legal? Would a tax that applied to all light vehicles be legal, including one that might largely replace registration fees (so may have a neutral effect on demand for light vehicles as a “good”)? Would it have been legal had the Department levied it as a fee based on costs of providing a service, rather than as a tax?

2. The Commonwealth can levy a tax charge such as the ZLEV, but only across all of Australia: If it were policy, the Commonwealth could pass legislation requiring all electric vehicles in Australia to pay a per km RUC. Similarly, could it apply it to all light duty vehicles? Arguably fuel excise duty does that now, but fuel excise duty strictly speaking affects demand for the fuels that are taxed, if you consider the definition applied by the High Court.

What happens next is obviously going to be a matter for the Victorian Government to consider, and indeed given both New South Wales and Western Australia have legislated for their own RUC systems to apply to electric vehicles from 2027, they will have an interest (along with all other States and Territories). Is it possible for them to design a road user fee, based on provision of a service (roads as a service) and the costs of providing it? If so, how could that be legally drafted without simply empowering a road manager to implement such a fee? Could it be applied across all road managers in Victoria? There are 79 local road managers and at least 1 state road manager in Victoria.

Victorian Premier Tim Pallas argued that it was about “fairness” and noted that electric vehicles were heavier and contributed more to “road degradation”. That latter point is highly questionable, but also not really relevant. The difference in weight between types of light vehicles makes very little impact on road wear, as most road wear and tear arises from the effects of weather and temperature, and the passage of heavy vehicles, not vehicles weighing < 4.5 tonnes.

The Commonwealth Government might be expected to have a view on the future of charging electric and other light vehicles for road use, as it was supportive of the plaintiffs. It would be reasonable to expect a policy position to be expressed in the coming months either to advance investigations in how RUC might be implemented for electric vehicles across Australia or to defer considering it until they are a larger proportion of the fleet. Ultimately it cannot be avoided, and it is in Australia’s interests to have a single coherent strategy to charging vehicles for using the roads, as it affects the sustainability and future of fuel excise duty. I hope that decisions are made in coming months for the Commonwealth to investigate pathways towards transitioning how light vehicles pay to use the roads, and alongside that, how revenue collected from them can be managed and efficiently distributed.

It's important to note that the Commonwealth already has a clear role regarding how heavy vehicles are charged for road use. Part of fuel excise duty is legally called a Road User Charge, which is what heavy vehicle pay to use the roads. Owners of such vehicles are entitled to refunds of the remainder of fuel excise duty when being driven on public roads (and to receive a full refund when driven off public roads). The Commonwealth has already been piloting options for a long-term transition from fuel excise duty and (State and Territory collected) registration fees towards paying by distance and weight. There is already some knowledge and understanding of the relevant issues within the Department of Infrastructure, Transport, Regional Development, Culture, and the Arts (DITRDCA).

Could States and Territories design a RUC that is not illegal?

It might be theoretically possible to design a light-vehicle RUC at the State and Territory level that does not come within the definition of excise, as indicated in Vanderstock & Anor v State of Victoria. Some of the characteristics of such a fee could include:

- It is a fee based on consumption of a service, not a tax. This affects how it is collected and how it is enforced.

- A fee that replaces another charge (aiming to be revenue neutral), such as replacement of registration fees. Arguably this would not affect demand for the “good” if it replaces a different type of tax.

- A fee that applies to all types of (light) vehicles, which is also a replacement of registration fees, so it does not affect demand for one type of vehicle.

- A fee that does not apply to consumption out-of-state. Victoria's tax applied to distance travelled anywhere on public roads, making it more difficult to claim that it was about consumption.

I suspect States and Territories might investigate such options, if they are determined to implement a form of RUC, but there may be a preference to simply leave it to the Commonwealth. Motorists are likely to prefer this, but the political will to do it will depend on one government taking a chance (and needing to work with the State and Territory Governments, all of which control motor vehicle registers essential to making it work), rather than eight separate entities doing so.

What does the Commonwealth need to consider?

Clearly the basis for having the Commonwealth proceed is that it is Commonwealth revenue being eroded by changes in vehicle technology. Given work already underway investigating RUC for heavy vehicles, it would make some sense to have a unified approach, which co-ordinates with States and Territories.

A wide range of issues would need to be considered including:

• What types of vehicles should first be moved onto RUC? Just those that pay nothing now (EVs), those that pay significantly less fuel tax (PHEVs and BEVs) or allow any light vehicles to opt into RUC?

• What would be the best basis for rate-setting? Should it be based on cost-allocation on a forward-looking cost base as has been proposed for heavy vehicles?

• Would it (and if so when would it) apply to vehicles currently paying fuel-excise and if so, how would fuel-excise be treated (i.e., refunded, credited to a RUC account)?

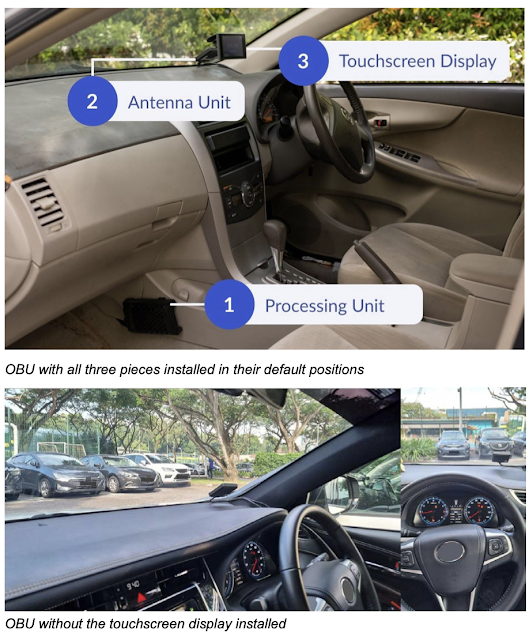

• What technical solutions would be suitable? Automated options require equipment to be installed or existing telematics to be used, manual options require verification.

• Will technical solutions be piloted with a section of the public (as is being done for heavy vehicles)? What would be the purpose of piloting RUC?

• Will revenues be hypothecated into a roads fund? If so, how would revenues be distributed among States and Territories compared to existing Commonwealth funding for roads?

• Would a Commonwealth RUC be applied at a single rate regardless of State or Territory, or have rates set that vary by location? A location based RUC would limit the technical options that would be feasible.

• What entities would be responsible for operation and enforcement of a Commonwealth RUC? How would a high standard of customer service be ensured?

• What roles would States and Territories have with a Commonwealth RUC?

What now?

Regardless of what happens, there would need to be a significant Commonwealth role in any case. It would be costly and complicated to have potentially eight different RUC systems, all of which are focused on collecting data and money from vehicle owners in their own borders, and to enforce RUC across them. It may have been less problematic for some (Tasmania, Western Australia and the Northern Territory all have low levels of cross border traffic), but much more complex along the eastern states and territory.

Given States and Territories have generally made EVs exempt from registration fees and are unlikely to want to apply RUC more generally across all light vehicles, it seems likely they will now turn to the Commonwealth to get some direction around how it wants to approach RUC for EVs and RUC more generally. This is an opportunity to consider the wider road charging and funding framework across Australia, including the role of fuel excise and registration fees. RUC is inevitable for highly fuel-efficient vehicles, the question is not if, but when, but it should be considered within the wider context of the questions outlined above.

With three US states having implemented RUC for parts of their light-vehicle fleets already (Oregon, Utah, and Virginia) and a fourth having mandated it (Hawaii), and multiple others piloting and investigating it (including the Federal Government), there is extensive experience in addressing many of these issues. New Zealand’s long standing RUC system will soon be extended to electric vehicles (it already covers all heavy vehicles, and all light diesel vehicles) also provides some useful lessons. There are also several pilots that have been undertaken in Europe.

The Commonwealth Government may not decide to do anything in the meantime, but that is a policy choice, and it could be undertaken with the clear message that it is intended to encourage growth in EVs and PHEVs. However, the easiest time to introduce a RUC is when the vehicles it is meant to apply to are few, and technical and policy options to do so can be easy to test. Australia has time to develop a strategy for road charging that might place both heavy and light vehicles within a single framework. It would be wise to do so over the next few years, and take the chance to bring States, Territories, stakeholders and most importantly, the public with it.